2nd Quarter 2025 Tax Deadline - 2nd Quarter 2025 Tax Deadline. We’ve compiled some of the most important information and dates to have you ready to. Here are a few key dates for 2025 to keep you in the know. 2025 Tax Deadlines — Ascend Consulting, Here's a detailed overview of the key dates: Estimated tax payments for the 3rd quarter of 2025 are due by sept.

2nd Quarter 2025 Tax Deadline. We’ve compiled some of the most important information and dates to have you ready to. Here are a few key dates for 2025 to keep you in the know.

Fiscal Year 2025 Quarter Dates And Deadlines Caro Martha, Estimated tax payments on income earned during the second quarter of the year (april 1, 2025, through may 31, 2025) are due today. The due date for filing your tax return is typically april 15 if you’re a calendar year filer.

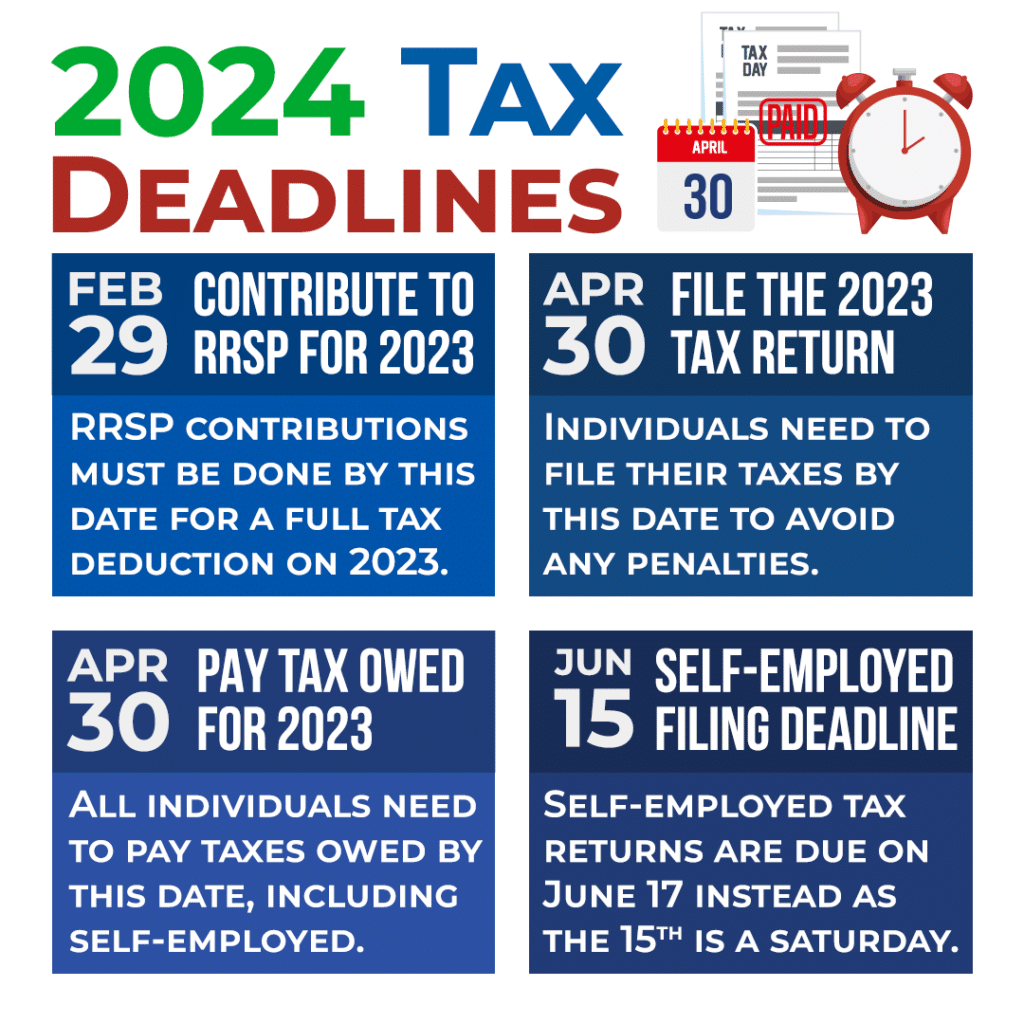

The deadline to file federal tax returns is april 15, 2025. Estimated tax payments on income earned during the second quarter of the year (april 1, 2025, through may 31, 2025) are due today.

Federal income tax returns are due on april 15, 2025.

Filing Taxes Deadline 2025 Natty Viviana, Under the provisions specified in section 234f of the income tax act, individuals who file their income tax returns (itr) after the due date are subject to a. Federal income tax returns are due on april 15, 2025.

.png?format=1500w)

Tax Deadlines For 2025 QualiVests, Estimated tax payments on income earned during the second quarter of the year (april 1, 2025, through may 31, 2025) are due today. Here is the income tax calendar for 2025 telling you all the important last.

2025 Quarterly Estimated Tax Due Dates And Dates Karyl Dolores, But that may not be the. July 15 is also the deadline to upload declarations received from recipients in form no.

Boston College Football Schedule 2025-25. “i would say yes,” armstrong. The acc completed their release […]

Estimated tax payment for 3rd quarter of 2025 employees must report august tips to their employer by sept.

When Is The Tax Deadline 2025 Uk Elvina Jacynth, Generally, most individuals are calendar year filers. Here's a detailed overview of the key dates:

The table below shows the payment deadlines for 2025.